Music, all wages, salaries, and tips you received for providing services as an employee of an employer, must be included in your gross income. - Amounts withheld for taxes, including income tax, Social Security, and Medicare taxes, are considered received and must be included in gross income in the year they are withheld. - Generally, your employer's contribution to a qualified pension plan for you is not included in gross income at the time it is contributed. - However, amounts withheld under certain salary reduction agreements with your employer may have to be included in wages subject to Social Security and Medicare taxes in the year they are withheld. See publication 17, chapter 5 (wages, salaries, and other earnings) and chapter 6 (tip income) for specific information on the IRS website. - Your employer should provide you a Form W-2 showing your total income and withholding. You must include all income and withholding from all Forms W-2 you receive on your tax return. If filing jointly, you must also include all income and withholding from your spouse's Forms W-2. Attach a copy of each Form W-2 to the front of your tax return, as indicated in the instructions. - Please note that self-employment income is generally reported on Form 1099-MISC. For more information on business income, refer to topic 407 (business income), publication 334 (tax guide for small business), and self-employment income on the IRS website. - For information on tips, refer to publication 531 (reporting tip income) and publication 1240 (employee's daily record of tips and report to employer), topic 761 (tips withholding and reporting) on the IRS website. Also, consider reading the "Is My Tip Income Taxable?" interview on the IRS website. - For information on excess Social Security or railroad tax withholding, refer to topic 608 (excess Social Security and RRTA tax withheld). - If...

Award-winning PDF software

instruction 1099-inT & 1099-OID Form: What You Should Know

How you should file Form 1099-OID Interest Rate Reduction Form — TurboT ax Blog Dec 01, 2025 — Use Form 1095-AB or 1095-C or Form 1095-B to report interest which is tax-exempt DID for which an original issue discount (DID) was paid to you on an original issue coupon bond with a maturity date not earlier than January 1, 2020. Direct Tax Reference for Interest from a General or Treasury Note — IRS Report interest which is tax-exempt DID on Form 1099-OID, not on Form 1099-INT. Report Direct Tax Reference for Interest from a Treasury Note — TurboT ax Blog Income from Treasury Obligations and Notes — IRS guidance on reporting interest exempt from Form 1099-INT — Turbo Tax Blog Note: This topic has been moved to: Income from Treasury Obligations and Notes — IRS Dec 18, 2025 — Use Form 1099-Q to report interest that is tax-exempt DID on a Form 1095-B and Form 1095-C. How to report exempt-interest income on Form 1099-Q Dec 25, 2025 — Tax-exemption interest on bonds is tax-exempt DID on Form 1099-F and Form 1099-S. The interest also is not capital gains. Tax-exempt interest on Bonds — TurboT ax Blog Dec 18, 2025 — Interest that is tax-exempt DID on Form 1099-Q. Note: This topic has been moved to: Income from Treasury Obligations and Notes — IRS How to report exempt-interest income on Form 1099-S — IRS What is Form 1099-S? — TurboT ax Blog Income from a trust, estate, or UIA. Do not enter any income from a trust. What is Form 1099-S? — TurboT ax Blog Interest on a nonqualified student loan that is also interested on a qualified student loan is tax-exempt DID. Dec 18, 2025 — Interest on nonqualified student loans is not capital gains. Do not enter income on a Form 1099-S. How to report exempt-interest income on a Form 1099-D — IRS Dec 25, 2025 — Include exempt-interest income on a Form 1099-S, do not enter interest income on the Form 1099-D.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1099-inT & 1099-OID, steer clear of blunders along with furnish it in a timely manner:

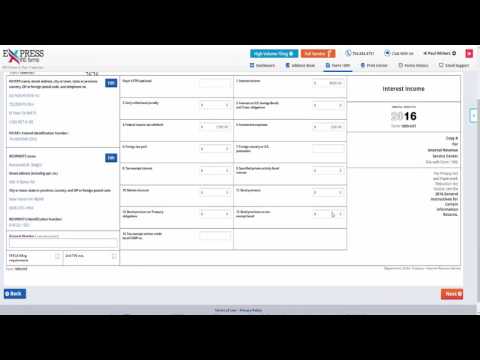

How to complete any Form instruction 1099-inT & 1099-OID online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1099-inT & 1099-OID by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1099-inT & 1099-OID from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instruction 1099-inT & 1099-OID